Glen,

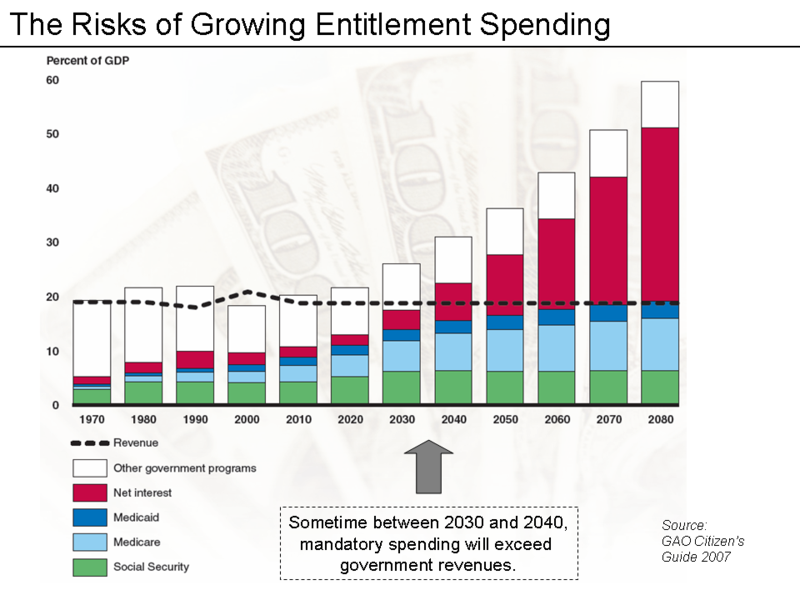

It would not matter whether or not the SS system was filled with cash, bonds or gold. It would never begin to cover the costs of what has been promised.

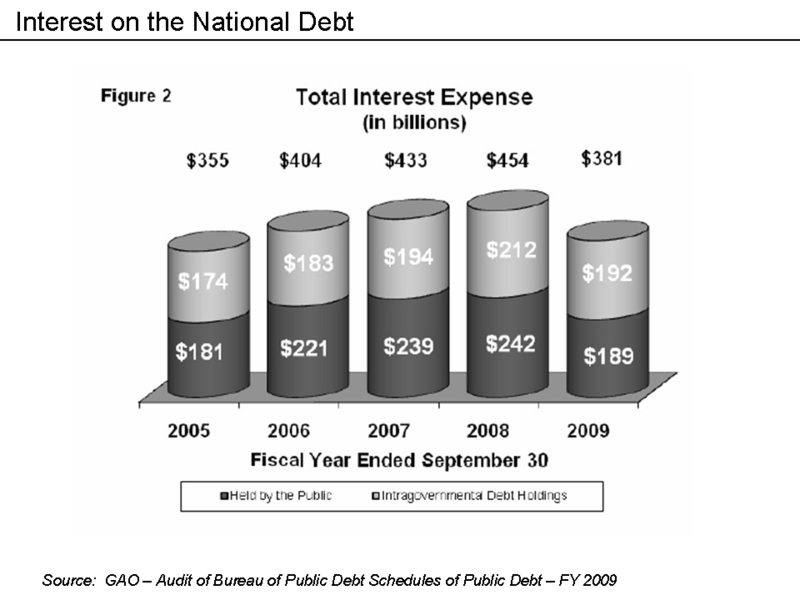

By law the only thing the Social Security trust fund can own is government bonds. When one looks at our national debt look under Intragovernmental Debt, that $4.9 Trillion amount includes the Social Security Trust fund, even if it was full of cash it doesn't mean anything other than taxpayers are on the hook to pay for it. That remains true today, there is still a trust fund and it is still liquid but it owns U.S. debt. That is what it would have owned even if the money wasn't borrowed from it.

Social Security is a pay as you go system, any surplus or trustfund is merely an accounting gimmick and it is a mirage. It as a mirage before Johnson used it to finance the Vietnam war and it was a mirage after.

By only holding bonds Social Security was loaning money to the Federal Government the day it withheld it's first dollar.

The Office of Management and Budget has described the distinction as follows:

These [Trust Fund] balances are available to finance future benefit payments and other Trust Fund expenditures ? but only in a bookkeeping sense.... They do not consist of real economic assets that can be drawn down in the future to fund benefits. Instead, they are claims on the Treasury that, when redeemed, will have to be financed by raising taxes, borrowing from the public, or reducing benefits or other expenditures. The existence of large Trust Fund balances, therefore, does not, by itself, have any impact on the Government's ability to pay benefits. (from FY 2000 Budget, Analytical Perspectives, p. 337)

It is instructive to note that the $2.5 trillion Social Security Trust Fund has value, not as a tangible economic asset, but because it is a claim on behalf of beneficiaries on the goods and services produced by the working population. This claim will be enforced by the United States Government although the precise monetary mechanism of enforcement is yet to be determined. In order to repay the Trust Fund, the United States government has three options, which may all be pursued to varying degrees.

(1) The government may issue debt by selling treasuries. Thus, $1 in debt to the Social Security Trust fund is replaced with $1 in debt to a different lender. This scenario would increase the tax burden on future generations if the interest rate is higher on the new debt. If the new debt is more expensive and government revenues do not increase sufficiently either through taxes of economic growth, the government would be forced to cut spending on other programs (such as Defense, Education, Research) or else default on all or part of the debt.

(2) The government may raise taxes. If taxes are raised across the board, ironically, by reducing take home pay for workers, the government could make it harder for the younger, working generations to invest and save for retirement. However, if taxes are raised only on those whose earlier tax cuts were partially offset by these excess FICA contributions, namely those taxpayers whose marginal rates were reduced from 74% to as little as 28% during the Reagan Administration, the younger, working generations will not lose any ability to save or invest.

(3) The government may monetize trust fund obligations by transferring the treasuries held by the Trust Fund onto the Federal Reserve balance sheet. In such a transaction, the bonds would become "assets" on the Fed's balance sheet, and the Fed would create money "out of thin air" to purchase the bonds from the government. Under such a scenario, the bonds are converted into cash, which would then be used by the government to cover social security payments. This scenario would likely lead to increased inflation, as it would inflate the money supply without directly increasing the amount of goods and services produced by the economy as a whole.

The net effect is that it doesn't matter whether or not a Social Security Trust fund exists, what matters is our government ability to finance it's debts. That would be the same whether or not Johnson spent the money or didn't spend the money.

Nemont